Income Tax 2014-15 – Exemptions available to Salaried Employees

Income Tax 2014-15 – Exemptions available to Salaried Employees for the Financial Year 2014-15 (Assessment Year 2015-16)

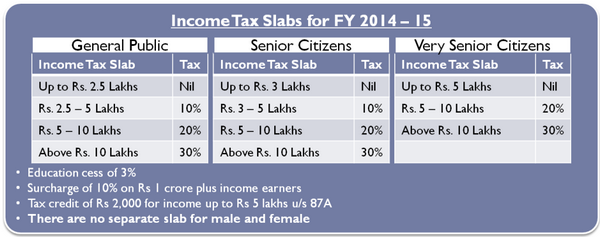

1. Taxable Income eligible for full exemption from income tax increased from Rs. 2 lakh to Rs. 2.5 lakh

2. Additional deduction of Rs. 50,000 under Section 80 C, CCC, CCD(1):

Deduction allowed under Section 80C, 80CCC, and Section 80 CCD(1) for savings/investments, premium for annuity / pension fund and employee contribution to NPS respectively has been increased to Rs. 1.5 lakh from Rs. 1 lakh (Section 80CCE Limit)

3. Income Tax exemption on Interest paid on housing loan under Section 24 of the Income Tax Act increased from Rs. 1.5 lakh to Rs. 2 lakh

In addition to above three new changes, Income Tax Rebate of Rs. 2000 for taxable income up to Rs. 5 lakh continues this year also under Section 87A of Income Tax Act

Click here to reach GConnect Income Tax Calculator 2014-15 (A. Year 2015-16) with save option

Click here to reach Instant GConnect Income Tax Calculator 2014-15 (A. Year 2015-16)

A brief on all eligible income tax exemptions applicable for the year 2014-15 is as follows

Allowances exempted under Section 10 of Income Tax Act

House Rent Allowance:

When rent is actually paid by an individual, he / she is entitled to exemption in respect of House Rent Allowance which is limited to least of the following

1. Actual HRA received.

2. Rent paid less 10% of salary.

3. 40% of Salary (50% in case of Mumbai, Chennai, Kolkata, Delhi) Salary is defined as Basic Pay. Dearness allowance will form part of salary if the same enters into computation of retirement benefits

Click here to reach Income Tax Exemption on HRA Calculator

Leave Travel Allowance or Leave Travel Concession :

LTC or LTA is exempted if the same is actually spent

Transport Allowance:

Transport Allowance granted to an employee to meet expenditure for the purpose of commuting between the place of residence and place of duty. Income Tax Exemption on Transport Allowance is restricted to Rs.800 per month.

Children Education allowance:

Rs. 100/- per month per child up to a maximum of 2 children.

Hostel Subsidy:

Rs. 300/- per month per child upto a maximum of two children.

Other Allowances exempted under Section 10 of IT Act.

Tour TA, Tour Daily Allowance, Academic, research or training allowance, uniform Allowance, Special Compensatory Allowance, High Altitude Allowance, Climate Allowance, allowances applicable to North East, Hilly areas of U.P., H.P. and J & K, border area allowance, Compensatory Field Area Allowance, Counter Insurgency Allowance, High Active Field Area Allowance, island duty allowance, tribal allowance etc.

Income Tax Exemption on Interest paid on Housing Loan / Income or loss from House Property:

Total deduction for interest paid on Housing Loan when the property is self occupied has been increased to Rs. 2 lakh as per amendment made in Section 24 of the Income Tax Act in 2014.

Click here to calculate Income Tax Exemption on Interest paid on Housing Loan

Also, in addition to Deduction of of Interest payable on Housing Loan up to Rs. 2 Lakh from the total income (and without any limit for Housing property rented out for an annual value), the new section in the form of Section 80 EE introduced in the last Budget (2013) provides for additional deduction / Income Tax Exemption for Interest paid on housing loan up to Rs. 1 lakh in respect of housing loan sanctioned / disbursed during the year 2013-14 for a first time house buyer with total property cost and amount of loan are not exceeding Rs. 40 lakh and Rs. 25 lakh respectively. This additional deduction of Rs. 1 lakh can either be availed fully in the income tax assessment year 2014-15 (Financial Year 2013-14) or partly in 2014-15 and remaining balance in Assessment year 2015-16 ( Financial Year 2014-15) in case interest payable in A.Year 2014-15 was not exceeding Rs. 1 lakh.

Section 80C:

The total deduction under this section (along with section 80CCC and 80CCD) is limited to Rs. 1.50 lakh. Some investments, savings, expenditure etc covered under Section 80 C are as follows

- Life Insurance Premium

- Premium / Subscription for deferred annuity For individual, on life of self, spouse or any child .

- Sum deducted from salary payable to Govt. Servant for securing deferred annuity for self-spouse or child Payment limited to 20% of salary.

- Contribution made under Employee’s Provident Fund Scheme.

- Contribution to PPF For individual, can be in the name of self/spouse, any child & for HUF, it can be in the name of any member of the family.

- Contribution by employee to a Recognised Provident Fund.

- Sum deposited in 10 year/15 year account of Post Office Saving Bank

- Subscription to any notified securities/notified deposits scheme. e.g. NSS

- Subscription to any notified savings certificate, Unit Linked Savings certificates. e.g. NSC VIII issue.

- Contribution to Unit Linked Insurance Plan of a Mutual Fund

- Contribution to fund set up by the National Housing Scheme.

- Housing Loan Principal amount paid

- Tuition fees paid at the time of admission or otherwise to any school, college, university or other educational institution situated within India for the purpose of full time education of any two children. Available in respect of any two children

Section 80CCC:

Premium Paid for Annuity Plan of an Insurance Company

Payment of premium for annuity plan of LIC or any other insurer Deduction is available up to a maximum of Rs. 100,000/-. (This limit has been increased from Rs. 10,000/- to Rs. 1,00,000/- w.e.f. 01.04.2007).

The premium must be deposited to keep in force a contract for an annuity plan of the LIC or any other insurer for receiving pension from the fund.

Note: The limit for maximum deduction available under Sections 80C, 80CCC and 80CCD(1) (combined together) is Rs. 1,50,000/- (Rs. one lakh and fifty thousand only).

Section 80CCD (1): Deduction in respect of Contribution to Pension Account (by Assessee}

Deduction available for the amount paid or deposited in a pension scheme notified or as may be notified by the Central Government subject to a maximum of :

(a) 10% of salary in the previous year in the case of an employee (b) 10% of gross total income in any other case.

Section 80CCD (2): Deduction in respect of Contribution to Pension Account (by Employer}

Deduction available for the amount paid or deposited by the employer of the assessee in a pension scheme notified or as may be notified by the Central Government subject to a maximum of 10% of salary in the financial year. This exemption is in addition to Rs. 1.5 lakh limit provided under Section 80 CCE for deductions under Section 80 C, CCC, and 80CCD(1)

Deductions under Chapter VIA of Income Tax Act

Section 80CCG: Rajiv Gandhi Equity Saving Scheme (RGESS)

As per the Budget 2012 announcements, a new scheme Rajiv Gandhi Equity Saving Scheme (RGESS) will be launched. Those investors whose annual income is less than Rs. 10 lakh (proposed Rs. 12 lakh from A.Y. 2014-15) can invest in this scheme up to Rs. 50,000 and get a deduction of 50% of the investment. So if you invest Rs. 50,000 (maximum amount eligible for income tax rebate is Rs. 50,000), you can claim a tax deduction of Rs. 25,000 (50% of Rs. 50,000).

Section 80D: Deduction in respect of Medical Insurance

Deduction is available up to Rs. 20,000/- for senior citizens and up to Rs. 15,000/ in other cases for insurance of self, spouse and dependent children. Additionally, a deduction for insurance of parents (father or mother or both) is available to the extent of Rs. 20,000/- if parents are senior Citizen and Rs. 15,000/- in other cases. Therefore, the maximum deduction available under this section is to the extent of Rs. 40,000/-. From AY 2013-14, within the existing limit a deduction of up to Rs. 5,000 for preventive health check-up is available.

Section 80DD: Deduction in respect of Rehabilitation of Handicapped Dependent Relative

Deduction of Rs. 50,000/- w.e.f. 01.04.2004 in respect of

- Expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative.

- Payment or deposit to specified scheme for maintenance of dependent handicapped relative.

Further, if the defendant is a person with severe disability a deduction of Rs. 100,000/- shall be available under this section. The handicapped dependent should be a dependent relative suffering from a permanent disability (including blindness) or mentally retarded, as certified by a specified physician or psychiatrist. Note: A person with ‘severe disability’ means a person with 80% or more of one or more disabilities as outlined in section 56(4) of the ‘Persons with disabilities (Equal opportunities, protection of rights and full participation)’ Act.

Section 80DDB: Deduction in respect of Medical Expenditure on Self or Dependent Relative

A deduction to the extent of Rs. 40,000/- or the amount actually paid, whichever is less is available for expenditure actually incurred by resident assessee on himself or dependent relative for medical treatment of specified disease or ailment. The diseases have been specified in Rule 11DD. A certificate in form 10 I is to be furnished by the assessee from any Registered Doctor.

Section 80E: Deduction in respect of Interest on Loan for Higher Studies

Deduction in respect of interest on loan taken for pursuing higher education. The deduction is also available for the purpose of higher education of a relative w.e.f. A.Y. 2008-09.

Section 80G: Deduction in respect of Various Donations

The various donations specified in Sec. 80G are eligible for deduction upto either 100% or 50% with or without restriction as provided in Sec. 80G

Section 80GG: Deduction in respect of House Rent Paid

Deduction available is the least of

- Rent paid less 10% of total income

- Rs. 2000/- per month i.e. Maximum Deduction available is 24,000/-

- 25% of total income, provided

- Assessee or his spouse or minor child should not own residential accommodation at the place of employment.

- He should not be in receipt of house rent allowance.

- He should not have self occupied residential premises in any other place.

Section 80GGA: Deduction in respect of certain donations for scientific research or rural development

Section 80GGC: Deduction in respect of contributions given by any person to political parties

Section 80QQB: Royalty Income on patents.

Maximum deduction Rs. 3,00,000/-

Section 80RRB: Royalty Income to author of certain books other than text books.

Maximum deduction Rs. 3,00,000/-

Section 80 TTA: Deduction from gross total income in respect of any Income by way of Interest on Savings account

Deduction from gross total income of an individual or HUF, upto a maximum of Rs. 10,000/-, in respect of interest on deposits in savings account ( not time deposits ) with a bank, co-operative society or post office, is allowable w.e.f. 01.04.2012 (Assessment Year 2013-14).

Section 80U: Deduction in respect of Person suffering from Physical Disability

Deduction of Rs. 50,000/- to an individual who suffers from a physical disability(including blindness) or mental retardation. Further, if the individual is a person with severe disability, deduction of Rs. 100,000/- shall be available u/s 80U. Certificate should be obtained from a Govt. Doctor. The relevant rule is Rule 11D.

RELIEF UNDER SECTION 89(1)

Relief u/s 89(1) is available to an employee when he receives salary in advance or in arrear or when in one financial year, he receives salary of more than 12 months, or receives ‘profit in lieu of salary’ covered u/s 17(3). Relief u/s 89(1) is also admissible on family pension, as the same has been allowed by Finance Act, 2002 (with retrospective effect from 1/4/96).

Click here to reach GConnect Income Tax Calculator 2014-15 (A. Year 2015-16) with save option

Click here to reach Instant GConnect Income Tax Calculator 2014-15 (A. Year 2015-16)

Also check the following links for more Income Tax 2014-15 related information

- Income Tax Return 2014-15 (Assessment Year 2015-16) last date extended

- Income Tax Return 2014-15 (Assessment Year 2015-16) – last date extended for Gujarat

- Special Counters for filing ITR by Salaried Employees

- How to e-file ITR ? Step by Step guide to file Income Tax Return online

- E-filing ITR – Steps to register at Income Tax website for filing Income Tax Return Online

- ITR – Income Tax Return 2014-15 (A.Year 2015-16) Explained

- ITR-V for 2013-14 and 2014-15 can be submitted up to 31st October 2015

- Online ITR 2014-15 (A.Year 2015-16) launched by Govt

- Who should file ITR online this year on the basis of Total Income ?

- Download ITR-1, ITR-2, ITR-2A 2014-15 for Salaried Employees released by IT Dept

The following amendments should be recommended in 7th Pay Commission.

1) Rotational transfers are only increasing Govt. Exchequer, so unless any administrative constraints, transfers should not be effected. The official who seeks transfer should not claim any TA or DA and thus whose transfer should not be effected in public interest.

2) Govt. Servants need not file any income tax returns, as they are already under the monitoring of their own Accounts Section and the Accts. Section files quarterly return procedurally.

3) All officials should get atleast 5 promotions in their full service career.

4) Reservations should not be effected in promotions, but in Recruitment/Appointment only. This will improve the quality of work in Govt. Organisations.

5) Officials in need of leave should be sanctioned. The slogan ” Leave is not a right” should be abolished from the pages of Rules book. Only in extreme Administrative Constraints only leave should be denied for an official.

6) Railway passes should be issued to officials for LTC instead of cash. Wherever the official/official’s family/official with family wants to visit, Railway reserved passes should be issued. Like Defence personnel (in allotment of Bogies in all trains) Govt. servant’s quota should also be there in all trains. Thus, an official with or without his family on LTC could visit any place at any time without any difficulty. By this mishandling of LTC facility will be avoided.

7) Officials of Gazetted ranks, wherever they are visiting could be allowed to stay Govt. Guest Houses in CPWD/other Govt. Guest Houses with messing facilities in economic rates. Accommodations should be according to their ranks.

8)

This website information is very useful to all section of people.

Thank you very much. This website is truly simple and very informative. All ones questions are answered here without creating a maze.

Nice information

Its very informative. All questions of mine r answered. Thank u fr dis website

No mid fr any other information all r provided here

sir

with due respect , i want to know that deduction under sec. 87 (a) (gross salary income up to 500000/- was deducted last financial year Rs. 2000. Is it applicable in this financial year 2014-15 ?

Yes. Rebate of 2000 is applicable this year also since Section 87 A is effective this year also

Very useful information for Tax Payers

nice information

whether management share will be deducted from total income

Its very usefull information to all catogories of persons filling Income tax returns.

Please give me information regarding exemption “any amount paid to widow mother either monthly or quarterly” for a income tax payer?