Homes in Austin, Texas, are selling for 19 percent above their fundamental value, according to a new analysis by Trulia, making it the most overvalued metro area in the country.

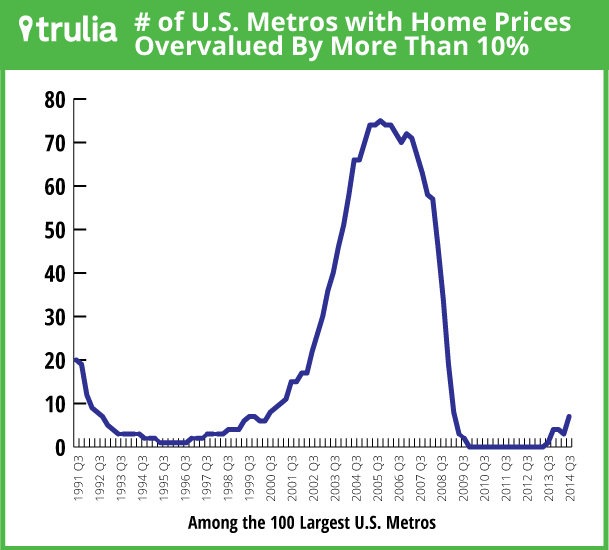

Austin is one of just seven metro areas in the U.S. in which home prices are more than 10 percent overvalued. Nationally, home prices were undervalued by three percent in the third quarter. By contrast, at the height of the housing bubble during the first quarter of 2006, home prices soared to a 34 percent overvaluation. In 2012 they dropped down to a 13 percent undervaluation

Related: 5 Reasons the Luxury Market Is Booming

The most overvalued markets after Austin are Los Angeles and Orange County, Calif., where homes are 15 percent overvalued. Two other California markets round out the top five most overvalued: San Francisco (12 percent) and Riverside, Calif. (11 percent).These California metro areas are still far less overvalued than they were at the height of the housing bubble, when San Francisco was 46 percent overvalued anRiverside was 87 percent overvalued.

Honolulu an San Jose are both 10 percent overvalued.

Austin and Houston, Texas (8 percent overvalued) are the only two of the 100 largest metro areas that are more overvalued today than they were in 2006, according to the Trulia analysis.

Related: Millennials Still Not Moving Out on Their Own

Still, the majority of markets appear fundamentally sound, when evaluated based on incomes, rents, and historical price paths. Rather than worrying about a nationwide bubble, Trulia economist Jed Kolko writes that the top housing concerns should be “weak construction and subpar young-adult employment.”

Top Reads from The Fiscal Times: