“We’ll have to walk and talk as we’re especially busy today,” explained Toland on the day of our interview. “I want us to do better. We’re obviously not where we planned to be seven or eight years ago. But we now have a clear strategy and a set of goals appropriate to our circumstances – in Dublin the near term objective is 25 million passengers by end-2017.”

An interview with Kevin Toland, Chief Executive, DAA

“No. I am not satisfied!” I had just asked the DAA CEO if he is happy with the 2013 traffic figures reported at the Dublin and Cork airports operator. If Dublin Airport repeats last year’s growth of 6% it will have 21.4m passengers in 2014 – the target in the 2010-14 corporate plan, which Toland inherited, requires 22m by 2014. The small shortfall does not seem substantial based on how long ago that target was set, and especially given the fact that it spanned an unprecedented deep recession heralded by the arrival of IMF inspectors in Dublin in the very same week that its new Terminal 2 opened in November 2010. It is towards that same terminal that we are now heading – Toland’s staff had set aside a room in the VIP suite for our interview, but we conduct most of our discussion on a powerwalk around the DUB premises.

“We’ll have to walk and talk as we’re especially busy today,” explained Toland. On the day of the interview, the centre-right European People’s Party congress is also meeting in Dublin hosted by Ireland’s Prime Minister, Enda Kenny. Ordinarily, such a gathering would probably pass as a mere formality, but the Crimean crisis and the presence of several heads of government, including Germany’s Chancellor Merkel, conspire to raise the convention’s profile considerably. The airport must go about its business with the clutter of armed police, and media satellite trucks. Toland chats easily with a Garda officer who lets us through the tight cordon, and we resume our discussion as we march along.

“I want us to do better. We’re obviously not where we planned to be seven or eight years ago, but the team here has made a lot of cuts and taken a lot of hard measures. But we now have a clear strategy and a set of goals appropriate to our circumstances – in Dublin the near term objective is 25 million passengers by end-2017.” (Dublin’s best-ever year was 23.4 million in 2008; last year’s traffic result of 20.2 million is comparable to 2006.)

“Ireland has been in a very deep recession and is only just emerging – the goal must be to outperform the market – to outpace GDP. We have very good indicators of achieving this – especially the double-digit growth on the North Atlantic, combined with a 35% improvement in transfer traffic last year. These are solid signs that a secondary hub is emerging. Our two largest customers, Aer Lingus and Ryanair, are growing, and we’re seeing positivity across our customer base.”

“Very strong commitments from the airline industry”

“Ireland is emerging from a very deep recession and our two largest customers, Aer Lingus and Ryanair, are growing – Dublin has had very strong commitments from the airline industry this year.” Last November Toland sat alongside the Irish Prime Minister and the Ryanair CEO to announce that the airline would be adding nine new routes in summer 2014.

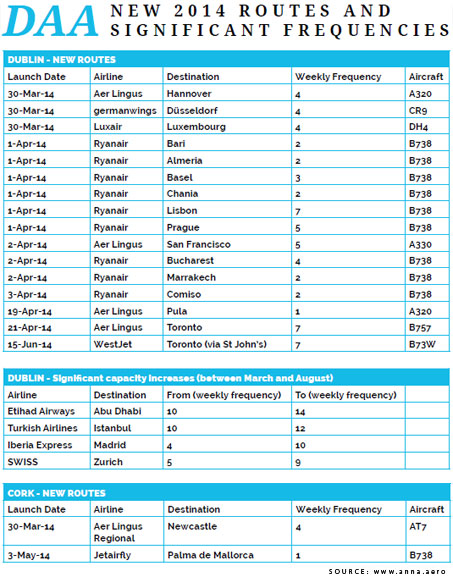

Ryanair’s latest good news came with some fanfare in November with Toland sitting alongside the Irish Prime Minister and the Ryanair CEO to announce that the airline would be adding nine new routes in summer 2014, as well as increasing frequencies to a further eight destinations, raising its passenger numbers at Dublin by almost 10% to an estimated 7.55 million in 2013/14 and to 8.25 million in 2014/15.

Indeed, after all the difficult years, Toland reports “Dublin has had very strong commitments from the airline industry this year.” This includes Emirates’ services to Dubai which have been doubled to twice daily; while frequencies to Etihad’s and Turkish Airlines’ competing hubs also become twice daily this summer, providing considerable choice over the airport’s historical reliance on Heathrow for Asian services. “This is stimulating the entire market at no cost to any player – indeed our traffic over London Heathrow is bigger than ever,” says Toland. However, the really good news comes in the form of the airport’s development into a north Atlantic “secondary hub” which sees Aer Lingus launching two additional new daily services in April – to San Francisco and Toronto, which will be joined by the arrival of WestJet’s landmark daily service via St John’s in June.

“WestJet had some very competitive choice of where it could have made its first landfall in Europe. But they chose Dublin. They tell me that they have experienced their largest-ever booking of a pre-launch service. Together with Aer Lingus’s new Toronto services, as Canada continues to thrive and the Irish economy recovers, I can see that many Canadians are going to come, demand is going to rise, and we are going to need services to the Canadian west coast too.”

The Canadian low cost carrier will, exceptionally, be using 737 narrowbody equipment – building on the significant developments pioneered by Aer Lingus which is “pathfinding” its Toronto route using leased 757s – much smaller than its existing A330s.

Separately, Aer Lingus told Airport Business that it may even develop more North Atlantic routes in the 170-200 seat sector. An order for up to 40 narrowbodies is to be announced over the next two years, possibly including transatlantic-capable A321neos. Meanwhile, a further east coast gateway and more services to Florida have been dangled by Aer Lingus as the next phase of its Atlantic ambitions.

“Developing a real working secondary transatlantic hub”

“Dublin is not Heathrow or Amsterdam. What we are building here is a real working secondary transatlantic hub in which people are already directly connecting from some 70 points across Europe. Dublin has the benefits of geography – and the unique advantage of preclearance by United States Customs and Border Protection.”

“Dublin is not Heathrow or Amsterdam, but what we are building here is a real working secondary transatlantic hub in which people are already directly connecting from some 70 points across Europe, and self-connecting by many more. For these purposes Dublin has the benefits of geography – and the unique advantage of preclearance by United States Customs and Border Protection (CBP), which is now comprehensively used by Aer Lingus and other airlines. In practice this means Aer Lingus flights now go straight to the domestic terminal at JFK where they mesh with JetBlue – the airline has a similar arrangement with United at Chicago offering genuine MCTs of as little as 45 minutes – hubbing in Dublin therefore has far more than just cost advantage.”

To encourage yet more airline business, DAA introduced its Growth Incentive Scheme in 2011, paying a rebate to airlines that increase passenger numbers. €5.6 million was rebated in 2013, the third year of the scheme, and it was recently extended for a further three years to 2016. So far €8.6 million in total has been rebated under the scheme. A figure approaching €10 million is a lot of money to DAA, but is it really significant when spread around Dublin’s airline partners given the scale of their investment? Toland thinks it is, and vigorously defends the effectiveness of the scheme: “Oh it definitely works. 5-6% traffic growth is mathematical proof it does, and the growth is in both directions. And if this trend is maintained, travel is going to double again in 10-15 years, especially as a lot people in Asia begin travelling for the first time.”

Having seen both Ireland’s economy and Dublin Airport overheat in the first decade of the 21st century, Toland says that the return to growth will be on stronger foundations this time. “Take the example of Aer Lingus’s re-establishment of a route to San Francisco. This originally failed because it was wholly dependent on discretionary tourism that evaporated when the stagnation arrived, and nobody could afford to vacation in Napa Valley anymore. This time the route has a multinational base – top IT companies such as Microsoft, Google and Yahoo have all set down deep roots in Ireland.”

Furthermore, Toland is cautious about when the return to growth will see a move back to the kind of significant investment which delivered the €600 million new terminal, or when the planned third runway will be built. “We’ll make sure we’re efficient, but it’s not binary to invest heavily in expansion. Although we do plan to re-appraise the need for a third runway, that won’t be until after 2019.”

New International Ambitions

Toland on daa International: “This takes advantage of our ability to run airports in Dublin and Cork, our considerable reputation for partnership in many different geographies in retail through ARI, and now our considerable new capability in building and finishing Terminal 2.”

In the meantime, while Terminal 2 matures into its role, it has started to pay another dividend with Toland firmly behind the launch last summer of daa International. “This is an entirely new business unit, building upon, but very different from Aer Rianta International’s retail focus over the past 25 years. daa International takes advantage of a number of things – our ability to run airports in Dublin and Cork, our considerable reputation for partnership in many different geographies in retail through ARI, and now our considerable new capability in building and finishing Terminal 2 – a lot of people can pour concrete but getting a building as complex as this ready on time is something else.”

Toland explains that the focus of daa International is not investments in the vein of Aer Rianta’s previous equity involvements in Birmingham, Düsseldorf or Hamburg, but in management contracts which will concentrate on “Unlocking Airport Value” for the investors themselves: “Another wave of privatisation is being stimulated by the easing of recessionary pressures. We have seen considerable activity by Canadian funds and others, such as construction companies, that have appetite to invest, but not necessarily the management skills to take over the running of those airports, and transition them to a new model where they can truly unlock the value. DAA’s enterprise experience is very extensive and we should use it.”

The route to transforming Cork’s fortunes

Unlocking the value of Cork Airport – ranked as the world’s best regional airport for customer service in the ACI Airport Service Quality (ASQ) Regional survey last year. “What Cork needs more than anything is a Dublin route which will strategically connect it to the emerging secondary hub.”

In the meantime, a key focus and responsibility for Toland is much closer to home: Unlocking the value of Cork Airport – the other core airport business in the DAA group. “Cork Airport was ranked as the world’s best regional airport for customer service by both business and leisure travellers in the ACI Airport Service Quality (ASQ) Regional survey last summer. This was deserved as we think the new terminal represents one of the best regional airport buildings in the world. The simple fact of the matter is that the Irish recession has been severe. However, while the position in Cork is down by some 20% since its peak, it could easily have been 30%. Cork’s tourism potential is tremendously strong with a hinterland which extends to Kerry and Tipperary – only 30% of traffic is inbound, so frankly we have to hold our nerve and build up the business.”

Ironically, while improved road connections have made a major contribution to Dublin’s improvements, with Northern Ireland-originating traffic up 15% last year, the same effect has impacted Cork, weakening the viability of domestic air services to the capital which is now currently unserved. Indeed Toland agrees: “What Cork needs more than anything is a Dublin route which will strategically connect it to the emerging secondary hub.” Toland and his team are meanwhile working hard to find an airline partner: “This route will do more than almost anything we can do to transform Cork’s fortunes.”

Despite coming to DAA after a quarter of a century in fast-moving consumer goods, where intense competition and extreme low costs and prices are core, Toland says he did not find airports to be a totally alien corporate environment. “Until I actually worked for this airport company I spent up to 160 nights a year away from home. Working in consumer foods I’ve visited more of the world’s airports as a real consumer than many others who consider themselves to be life-long airport experts. Of course I’ve had fast track learning about all sorts of airport processes, but in airports, and in all businesses, it’s all about being 100%. Just like in consumer foods, our product is the passengers’ first point of goodbye and hello – everyone in the entire team has a role and contribution to make, and we’ll all fall or rise with the weakest and strongest performers. All businesses have customers, we all have shareholders, and they’ve all got to be satisfied.”

Indeed Toland recognises, but also rejects, the sentiment that air transport and airports should be considered to be fundamentally different businesses than any other because of the responsibility held for operating key and dominating infrastructure. “There’s a lot of self-perception that aviation is somehow special, but that doesn’t help with competitiveness. After all, there’s a lot of compliance and regulation in foods too – the requirements for food safety, traceability etc have gone wild in recent years. While it’s a fact that there are some very important distinctions – after all, our customers can’t swap their choice of airports in quite the same way they can select breakfast cereals – on the other hand it doesn’t matter what brands and infrastructure you have, if you are not always at your best, you are soon going to find yourself uninvented in the marketplace. There is no captive customer, in either mass consumer brands or airports, and it is very dangerous to believe there is.”