Education

Curtis Shelton & Dave Bond | September 19, 2017

Oklahoma public school revenues are higher than ever

Curtis Shelton & Dave Bond

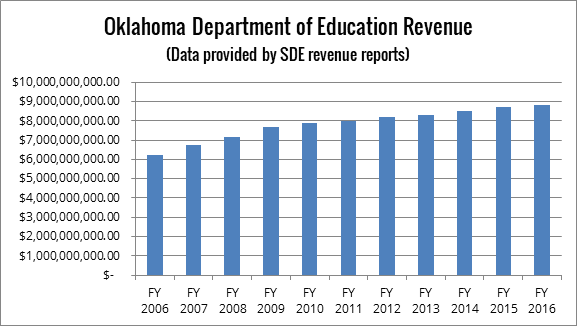

Total revenues for Oklahoma public schools are at an all-time record high. Since 2006, school revenues have risen by more than $2.5 billion, or 41 percent, and now stand at over $8.8 billion.

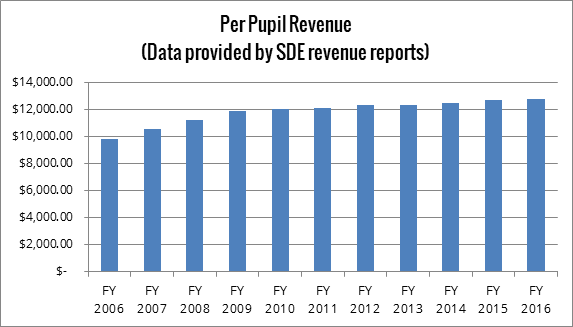

This amounts to per-pupil revenues of more than $12,700 per student across the state, an increase since 2006 of more than $2,800 per student, or more than 29 percent.

Seriously. No fooling.

Regardless of how much money state legislators appropriate each year, Oklahoma’s total state government spending has now reached $17.9 billion, an all-time record high.

In much the same way, despite sky-is-falling rhetoric from labor union leaders and well-compensated school administrators, total annual public school revenues in Oklahoma have consistently climbed upward for more than a decade, as have per-pupil revenues.

Much of this increase is due to rising revenue from local sources, such as ad valorem taxes — i.e., property taxes, which are collected and spent by local governments and school districts rather than by state government.

From 2006 through 2016, the most recent year for which complete data from the state Department of Education is available, total public school revenues in Oklahoma hit record highs every year, as did per-pupil revenues.

During this period, Oklahoma’s personal income tax burden was gradually reduced by more than one-fourth, and tax collections from oil and natural gas drilling fluctuated dramatically.

It’s important to understand the difference between state appropriations for public education and total revenues for public schools. State appropriations for public education are part of “the state budget” that lawmakers at the Oklahoma Capitol vote on each year, which also includes funding for roads, bridges, prisons, troopers, health programs, colleges, universities, and more.

Total public school revenues, meanwhile, are the sum of all the many different sources of funding that flow to — and are spent by — Oklahoma’s PreK-12 public schools.

In its overview of total school revenues, the state Department of Education lists 53 different funding line items for public schools, only 21 of which are state sources.

Total public school revenues include state appropriations, as well as pre-dedicated “off the top” state funds (a.k.a. "approtionments"), federal funds, local property tax collections, carryover funds from prior school years, local bond sales, and more.

In recent years, state funds — including appropriations and all other state dollars — have consistently made up less than half of total revenues for Oklahoma public schools. In 2006, state funds made up about 39 percent of total school revenues. By 2016, state funds made up only about 31 percent.

Yet, while the size of the slice varied, the pie as a whole grew considerably larger. In 2006, total revenues for Oklahoma public schools added up to more than $6.2 billion. By 2016, total revenues had risen to more than $8.8 billion, an increase of more than 41 percent.

In 2006, average per-pupil revenues in Oklahoma public schools were $9,824 for the 634,468 students statewide. By 2016, average per-pupil revenues had risen to $12,722, an increase of more than 29 percent, for the 692,670 students statewide.

Though federal funding for Oklahoma public schools is below what it was during the recession, it’s still higher than in 2006. Federal funds in 2006 totaled about $640 million. Federal funds in 2016 totaled more than $695 million, an increase of more than 8 percent.

The area of school funding that increased the most was funding from local ad valorem taxes—i.e., property taxes. In 2006, local ad valorem taxes for schools added up to more than $1.21 billion. By 2016, they had risen to more than $2.05 billion, an increase of more than 69 percent.

Those who suggest Oklahoma schools are starved for funding tend to focus solely on dollars allocated by state government, and often only on state appropriations. Thankfully, Oklahoma's public schools have a diversified portfolio of revenue streams, allowing total school revenues to increase every year since at least 2006.

Tragically, too much of this increased funding hasn't made it to the classroom, where it could most directly benefit students.

Oklahoma parents and taxpayers should demand that local public school officials direct a higher percentage of education dollars to the classroom, starting with a teacher pay raise.

At the same time, state lawmakers should remove restrictions that unnecessarily limit the flexibility with which school revenues can be utilized in the best interests of students.

For instance, lawmakers should send to a vote of the people a resolution allowing a larger percentage of local ad valorem dollars to be utilized for teacher salaries and other classroom expenses, rather than for buildings and technology upgrades only.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.

Dave Bond

Vice President for Advocacy

Dave Bond serves as Vice President for Advocacy at the Oklahoma Council of Public Affairs. He was previously the CEO of OCPA Impact, OCPA's 501(c)4 action partner. Since 2011, Dave has advocated at the Oklahoma Capitol on issues of free enterprise, individual initiative and limited government. He has been referred to in the Tulsa World as "a prominent Oklahoma anti-tax lobbyist". Prior to his advocacy efforts, Dave worked in Oklahoma elections, focused mostly on state legislative campaigns. He was the executive director of the Republican State House Committee, the campaign arm of the Republican caucus of the Oklahoma House of Representatives. Dave also worked with the campaign consulting firm A.H. Strategies and with the inaugural campaign of former Corporation Commissioner Jeff Cloud. In addition, he served in the media and communications divisions of the Oklahoma House of Representatives. Dave has lived in Oklahoma most of his life and is a graduate of Oklahoma State University. He and his wife Marsha have two sons and live in Yukon.