MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only.

Wave Financial Review

Table of Contents

Wave Financial is our choice for the best free accounting software, thanks to its solid set of features and simple-to-use interface. The software offers several time-saving tools, including invoices, payment reminders and financial reporting.

- You can send unlimited invoices in Wave Financial without spending any money.

- For a free platform, Wave offers an impressive number of reports. Plus, the report-generation process is exceptionally intuitive.

- A manual transaction entry in your Wave books is more straightforward than in many paid platforms.

- Wave lacks tools for tracking billable hours, inventory or purchase orders.

- Receipt uploads and tracking are paid add-on features.

- Receipt uploads and tracking are paid add-on features.

In our search for the best free small business accounting software, we looked for an easy-to-use application — one that has a solid suite of features and, of course, is free to use, with no mandatory costs for the user.

We wanted it to be a web-based solution that has time-saving features. For example, a reporting suite that busy small business owners can use to accomplish accounting tasks in very few clicks. We also looked for a solution that gives users the option to accept invoice payments online, even though we recognized that there would be a cost for this last feature.

After much research and analysis of accounting software, we recommend Wave Financial as the best free accounting software for small businesses.

[Related Read: Best Accounting Software For Small Business]

Wave Financial Editor's Rating:

8.5 / 10

- Affordable pricing

- 10/10

- Free trial

- 10/10

- Robust integrations

- 5/10

- Invoicing and bill pay

- 7.5/10

- Mobile app

- 10/10

Why Wave Financial Is Best for Free Accounting Software

Wave Financial’s free accounting software plan is well suited for service-based businesses that are just starting out or plan to remain small. Specifically, it’s a good fit for the self-employed — solopreneurs, freelancers and consultants — and very small businesses (10 or fewer employees) that have limited or no inventory.

Fundamental yet powerful invoicing and reporting features are part and parcel of the free Wave experience. We were happy that creating, sending and tracking invoices was such an easy experience in a fully free platform. We also loved how deftly we could create reports in Wave; plus, given the no-cost software, we liked which reports were available, too. For accounting fundamentals at no cost minus unavoidable payment processing fees, we recommend Wave, especially for small service providers.

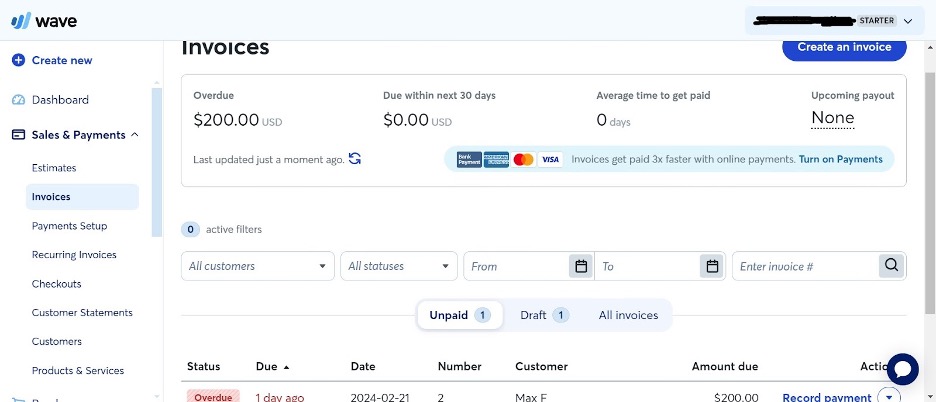

Non-paying Wave Financial customers immediately see their overdue and soon-due invoice amounts alongside a list of unpaid invoices. Source: Wave Financial

Usability

Wave Financial offers a highly user-friendly experience, and this is what we would expect of a free platform. After all, free apps typically include fewer features than paid ones, so there are fewer tools within them, inherently leading to less clutter. This is exactly what we experienced with Wave.

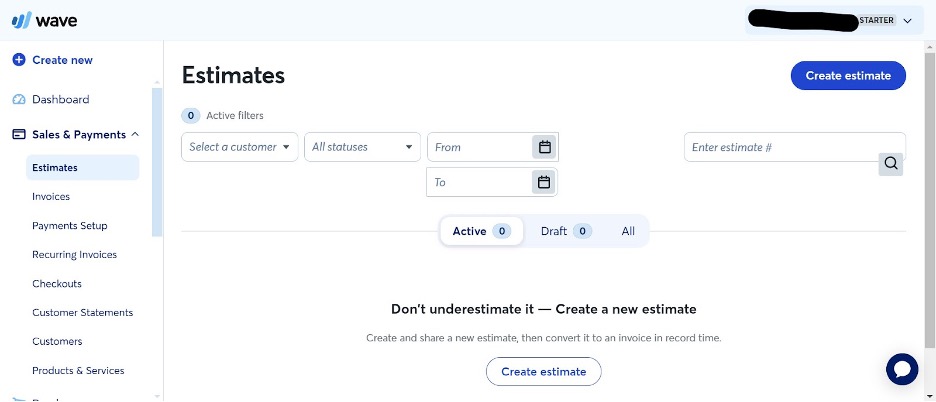

We love that Wave’s main modules are all reachable via the left-side navigation bar. We also appreciate that each module includes a drop-down menu from which you can quickly access key features. For example, the Sales & Payments drop-down leads you directly to tools including Estimates and Invoices. We found this arrangement highly intuitive to navigate, and we had no trouble finding the accounting tools we needed.

Each main module in Wave Financial doubles as a drop-down menu through which you can instantly access key tools. Source: Wave Financial

The tools themselves were also straightforward. Even when we followed the manual-entry route when testing Wave, the interface for adding information was uncrowded and hassle-free. Between these tools’ actual functionality and their appearance, we found them exceptionally user-friendly. Sure, they weren’t quite as user-friendly as the similarly low-feature platform Melio. However, we were still more than happy with the Wave experience.

Melio is our top pick for free accounts payable tools. Read our Melio review to learn why.

Wave Financial Features

Invoicing | Easily create, send and track invoices, which you can also manage on the go via the Wave mobile app. |

|---|---|

Bookkeeping | Enter transactions into Wave manually or via your linked business bank account. |

Reporting | Rapidly generate just over a dozen fundamental accounting reports, including general ledgers, sales tax reports and balance sheets. |

Integrations | Connect Wave with hundreds of apps through Zapier, and link Wave with Shopify through a paid integration. |

Payment options | Offer ACH bank transfers, credit card payments and Apple Pay to your customers. |

Multi-business support | Manage several businesses’ accounting through your free Wave dashboard. |

The main thing small business owners look for in accounting software is features that save them time. Wave provides several automated features that fulfill this requirement. While Wave might not have as many features as some of the other accounting software solutions on the market, it offers a good set of features for a free product.

Invoicing

We found Wave’s invoicing suite to be among the easiest to use across all accounting platforms. No, it wasn’t quite as user-friendly as the invoicing suite in our review of FreshBooks, which was our top pick for invoicing. However, it was crisp, clean, and easy to use (and customize with our branding), leaving us overall impressed. Plus, we faced no limits on the number of invoices we could create per month, which isn’t always the case with accounting software.

We liked that, in Wave, it took only two clicks for us to convert the estimates we’d previously sent to customers into invoices. We liked how much time this saved us on reentering and copying data. We also liked that we could set up automatic payment reminders to encourage customers to pay their bills on time. Additionally, we were pleased that all non-paying Wave users can send overdue payments for online invoices three, seven and 14 days after the due date.

At the same time, for free users, the Wave invoicing suite is a bit basic. Only paid users can schedule and automatically send invoices to customers via recurring billing, such as for regularly scheduled services or subscriptions.

Additionally, from Wave’s mobile app, you can invoice your customers on the go. We found it just as easy to create, customize and send invoices on mobile as on desktop with Wave Financial.

Bookkeeping

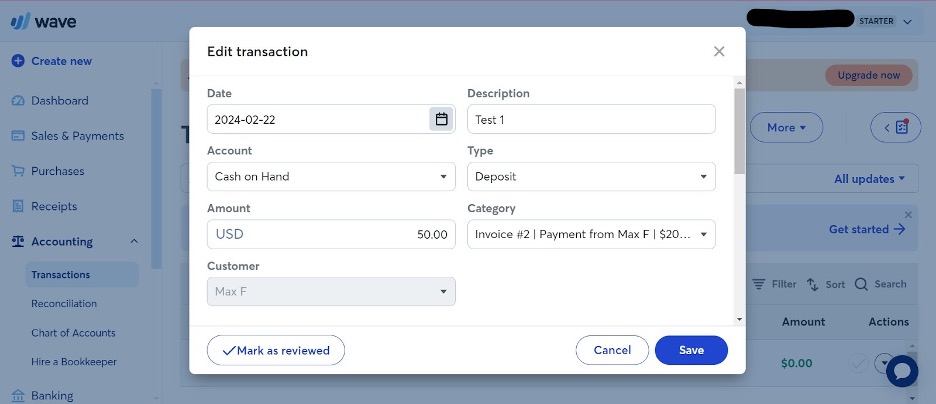

Wave’s free plan includes basic bookkeeping tools that we found to be clean, clear and well organized. In particular, we found it easier to manually add income and expenses through Wave than with most other accounting software we tested. There weren’t a ton of fields to fill out, and we could easily connect transactions to invoices. This was basically manual bank reconciliation, which is an automated feature in most accounting platforms. However, given that Wave is free, we were happy with the unexpectedly user-friendly manual bookkeeping tools.

There’s no clutter when you manually add transactions to your books in Wave Financial, and there are only a handful of fields to complete. Many of these fields have user-friendly drop-down categories as well. Source: Wave Financial

Reporting

Wave can easily and quickly create accurate financial reports such as balance sheets, sales tax reports, profit and loss statements, a general ledger, and aged receivables. There are also cash flow statements and aged payables reports.

When we tested the Wave reporting suite, we liked how easy it was to set a date range and report type. We also liked that seeing the results simply required us to scroll down. This ease of use paralleled what we found in our Sage 50 review (this platform is our top pick for reporting).

We were also impressed with how many reports Wave makes available. Given the no-cost usage, we expected very few reports; with 14 reports total, we were happy. Sure, this quantity of reports is nowhere close to what you get with Sage 50 or QuickBooks. But when you remember that Wave Financial is free to use, this number of reports becomes no small feat.

QuickBooks is our top pick for small business accounting software. Check out our Intuit QuickBooks accounting software review to learn why we like this platform so much.

Integrations

Wave integrates with Shopify, though you must connect the platforms through your Shopify account and pay extra for this integration. Wave also connects to Zapier — which you can use to integrate Wave with hundreds of apps — and provides several “Zaps” on the Integration tab of your account that make it easy to connect.

We liked how many options Wave’s Zapier integration gave us for connecting the programs with other platforms. This is a step up from the integrations that come with paid platforms that are narrowly dedicated to one accounting need. For example, as detailed in our Neat review, this platform has under a dozen integrations but costs at least $16.66 per month. To get access to hundreds of integrations through Zapier while using Wave’s fully free accounting platform surprised and excited us.

Payment Options

In addition to accepting credit card and ACH payments online for invoices, Wave also supports Apple Pay. This is a useful feature for businesses that require payment upfront. Plus, you can embed these payment options right into your invoices.

Although payment processing isn’t itself free with Wave — it never is — we appreciate the convenient options that Wave offers your customers for paying you. In fact, we felt that this convenience increases the likelihood of you receiving payments on time.

Multi-Business Support

You can set up multiple organizations under your Wave account and switch between them. You can’t move transactions between businesses, however; there isn’t a platform that allows you to monitor multiple businesses at once. Nevertheless, we were happy to see multi-business support in Wave because this feature is standard across accounting platforms. Moreover, since Wave is free, you’re fully empowered to manage your finances across several businesses for no cost other than that of payment processing.

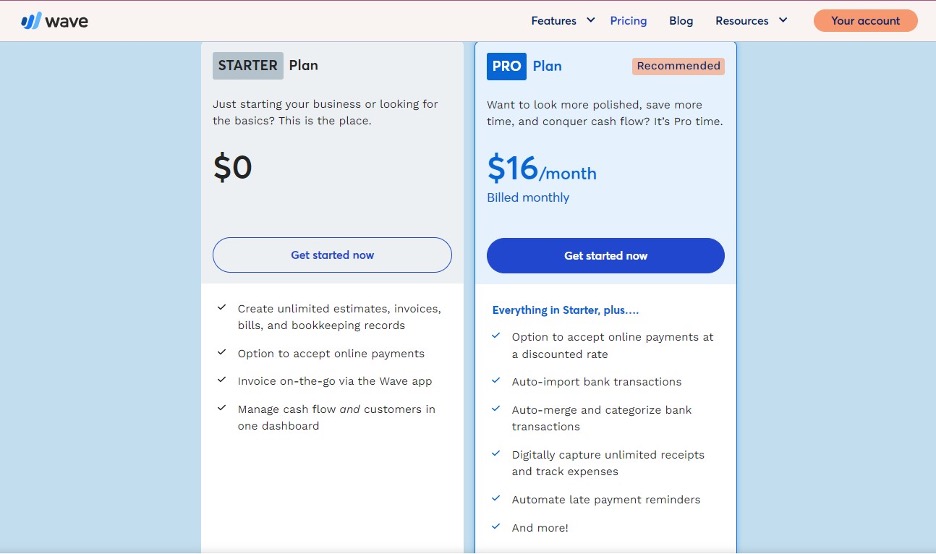

Wave Financial Costs

Wave’s pricing has changed substantially over our years of reporting on the app. Yes, it’s still our top choice for free accounting software, but many features that were once free now require payment to use. Whereas Wave used to offer all its accounting features for free and only charge payroll users, there’s now a free and a paid Wave plan. We’re disappointed that this pricing change has relegated some previously free tools, such as bank transaction auto-import, to paid status.

Wave’s current pricing is as follows:

- Starter: Free. This plan includes all the features discussed in this review.

- Pro: $16 per month if billed monthly or $14.17 per month if billed annually.

Wave Financial used to offer all of its accounting features for free, but it now relegates some — including many important ones — to a paid plan. Source: Wave Financial

Additionally, even with Wave’s Starter plan, it costs extra to accept online payments. The cost for this feature starts at 2.9% per transaction. This is similar to the standard rate across the best credit card processors, but it does technically mean Wave isn’t free. Additionally, bank payments you receive through Wave incur a 1% transaction fee, with a minimum of $1.00.

Other add-ons for which you must pay include:

- Receipt capture: $11 per month or $96 per year (included for Pro users)

- Payroll: Starting at $20 per month

- Hiring a bookkeeper: Starting at $149

There are no implementation costs for Wave, nor are there additional costs to add more users. The lack of implementation costs is standard in accounting software, and additional per-user costs are rare but non-zero. We were happy that Wave doesn’t charge per-user fees, unlike FreshBooks.

Wave Financial Setup

Wave is among the easiest accounting platforms to set up. Once you create an account using your email address and password, you’ll enter your first and last name, business name, industry, and legal structure. You’ll then add your starting year, approximate number of customers and whether you accept online payments.

From there, you’ll let Wave know what you need from the platform, such as invoicing and bookkeeping. You can also indicate that you don’t quite yet know what you need from Wave. Thereafter, you’ll choose Wave Starter to avoid paying for the service, and you’ll add your phone number. Next, simply link your bank account to power your bookkeeping and, if applicable, online payments. The whole process took us about five minutes and was much easier than what we went through for most platforms.

Wave Financial Customer Service

Wave’s customer service deeply left us wanting for more. We should’ve expected this from a free platform, but we were still disappointed.

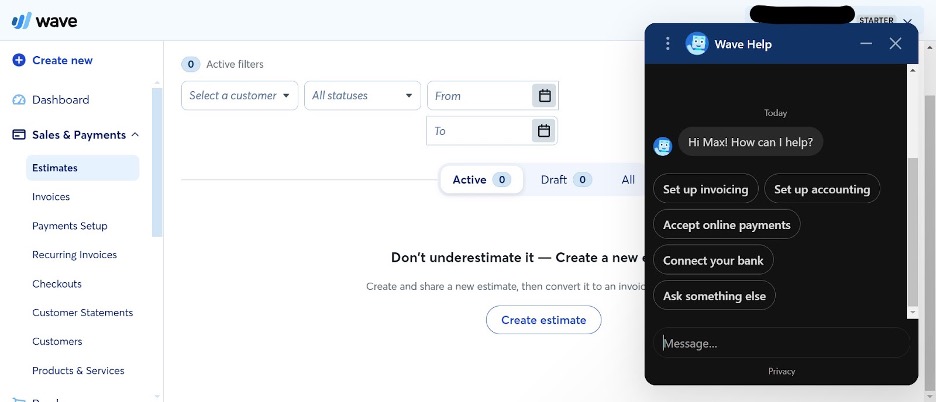

Beyond Wave’s automated support chatbot and help center — both of which all users can access — most support is reserved for Pro customers. We did like that the chatbot, which Wave calls “Mave,” is always visible at the bottom-right corner of the app. We also liked that Mave greeted us with a handful of easy-click buttons, such as “set up invoicing,” to begin our support journey. This streamlined our already simple Wave implementation.

Pull up Mave (Wave Financial’s automated support chatbot) at the bottom right, and you’ll see quick help prompts to start getting the answers you need. Source: Wave Financial

However, only for paying users does Wave replace this chatbot with actual live chat support. Similarly, only paying users can reach support via email — and there’s no Wave phone support whatsoever. The lack of easy access to Wave support is a major recurring theme among the numerous negative Wave reviews on the Better Business Bureau website.

You qualify as a paying user if you use Wave for online payments, payroll or receipt scanning. In that case, you can reach support from 9 a.m. to 4:45 p.m. ET on weekdays. However, since not all free users get access to support, nor is phone support available, Wave ranks poorly for us in customer service. Even Xero’s support ticketing system, which we found to introduce needless obstacles, is better than Wave’s support.

Xero is our top accounting software for bill pay despite its flawed customer support. Discover why we love this platform so much via our Xero review.

Wave Financial Drawbacks

Wave is excellent free accounting software for small businesses — especially new, service-based businesses with very tight budgets — and has a good selection of features. But it’s missing a few that some businesses may consider necessities, such as the following abilities:

- It doesn’t track billable hours, and the ability to track expenses via receipts is a paid add-on. [Related Read: Receipt Tracking Solutions for Small Businesses]

- It doesn’t track inventory or create purchase orders, which is inconvenient for companies that carry more than just a few products.

- It’s missing fixed asset management tools, which may be problematic if you need to calculate depreciation on computers, equipment and office furniture for taxes.

While the lack of advanced features is a drawback, it is important to remember this is a free service. For no-cost accounting software, you can’t get much better than Wave.

Methodology

When we searched for the best free accounting software, we looked for software that made it simple to track invoices and expenses. We also sought platforms that enable quick online customer payments and rapidly generate fundamental reports. After much research and analysis of competitors like Zoho Books (which offers free plans for microbusinesses), we recommend Wave Financial as the best free accounting software. [Learn more about free microbusiness accounting software via our Zoho Books review.]

We spent several hours using Wave, reviewing its web pages and comparing it to other top accounting software platforms. We also looked into its real customer reviews to see what people truly think of the platform.

Wave Financial FAQs

Yes, if you use Wave’s Starter plan without accepting online payments through the app. Otherwise, Wave costs money to use.

If your business accepts payments through Wave, chances are the app will generate a 1099-K form for your business and submit it to the IRS.

Yes. H&R Block acquired Wave Financial in 2019.

Overall Value

We recommend Wave Financial for…

- Small businesses on a tight budget in need of free invoicing, bookkeeping and reporting software.

- Service-oriented businesses that live and die by invoices for managing accounts receivable.

- Any business that’s OK with forgoing some fundamental accounting software features for entirely free yet still incredibly user-friendly invoicing.

We don’t recommend Wave Financial for…

- Small businesses in need of all accounting software fundamentals, even if paying for these features if necessary.

- Small businesses that need phone-based customer support as part of their accounting software package.

- Small businesses that claim depreciation as a tax-deductible expense every year.